Toronto Home Market: Rates Drop, Sales Rise

Meta Description:

The Toronto Home Market saw sales climb 8.5% in September as rates fell. See how lower borrowing costs and commute trends are shaping demand.

A Market Finding Its Footing

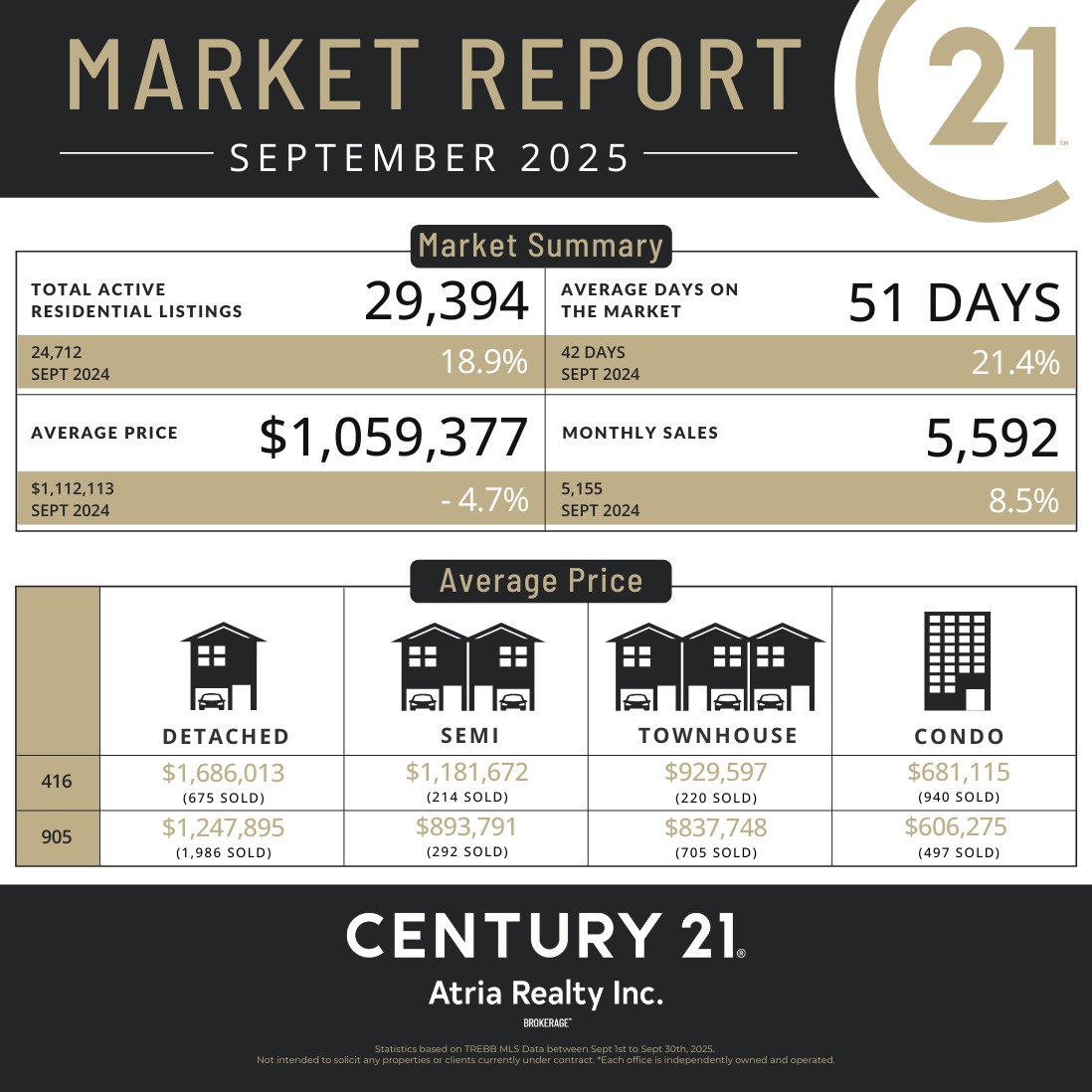

The Toronto Home Market showed signs of recovery in September. Home sales rose 8.5% compared to last year, according to the Toronto Regional Real Estate Board (TRREB). That means 5,592 homes changed hands — a clear sign that buyers are slowly returning.

The boost followed the Bank of Canada’s rate cut to 2.5%. Lower borrowing costs made it easier for families to qualify for a mortgage. Many households can now afford homes that meet their needs again.

TRREB President Elechia Barry-Sproule said the shift is giving buyers more confidence.

👉 Source: TRREB Market Report, October 2025

Prices Ease, but Optimism Grows

Average prices slipped 4.7% from a year ago to $1,059,377. The MLS® Home Price Index also fell 5.5%. Still, prices rose slightly compared to August, hinting at a more stable market.

Realtor Cailey Heaps noted that conditions are improving. “We’re likely near the bottom, and it feels like a good time to buy again,” she said.

Detached and semi-detached homes led the increase in sales. Condos and townhouses followed closely behind. Buyers appear cautious, but they’re starting to test the market again.

Commute Times Are Reshaping the Toronto Home Market

Traffic is playing a bigger role in how people choose where to live. Realtor Steve Fudge from Bosley Real Estate said that showing homes across the city now takes him twice as long. “It’s just so exasperating to get across Toronto,” he explained.

Because of this, many buyers prefer homes near transit or major highways. Suburban areas like Markham, Richmond Hill, and Vaughan are gaining popularity. They offer better value and easier access to the city.

Developers Respond to Buyer Trends

Builders are adapting to these new preferences. Jennifer Keesmaat, CEO of Collecdev-Markee Developments, said new projects now focus more on walkability and transit access than on parking.

“When it takes two hours to reach somewhere that should take 15 minutes, quality of life drops,” Keesmaat said.

Many families are also embracing condo living. For them, location and convenience matter more than square footage.

What’s Next for the Toronto Home Market

Listings jumped 18.9% compared with last year, giving buyers plenty of options. However, if interest rates drop again, that advantage may not last long.

Jason Mercer, TRREB’s Chief Information Officer, believes that “two more rate cuts could align mortgage payments with household incomes and boost sales.”

For now, the market feels steady but cautious. Buyers are beginning to act before conditions tighten again.

Final Thoughts

The Toronto Home Market continues to balance between recovery and restraint. Lower rates and more listings are helping buyers re-enter the market, while commute patterns and lifestyle choices shape where they go next.

If you’re thinking about moving, now could be the right time. Acting early in a stabilizing market often creates better results.

📩 Questions about the Toronto Home Market? Contact me today — let’s talk about your next move.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link