Bank of Canada Rate Cut & First-Time Buyer Trends: What It Means for You

Introduction

The Bank of Canada rate cut is finally here, and it could be a game-changer for first-time homebuyers Canada is depending on. The central bank lowered its key interest rate from 2.75% to 2.50%, the first cut since March. This move is designed to support the economy, but it also raises important questions for new buyers and homeowners alike.

How the Rate Cut Impacts Homeowners and First-Time Homebuyers in Canada

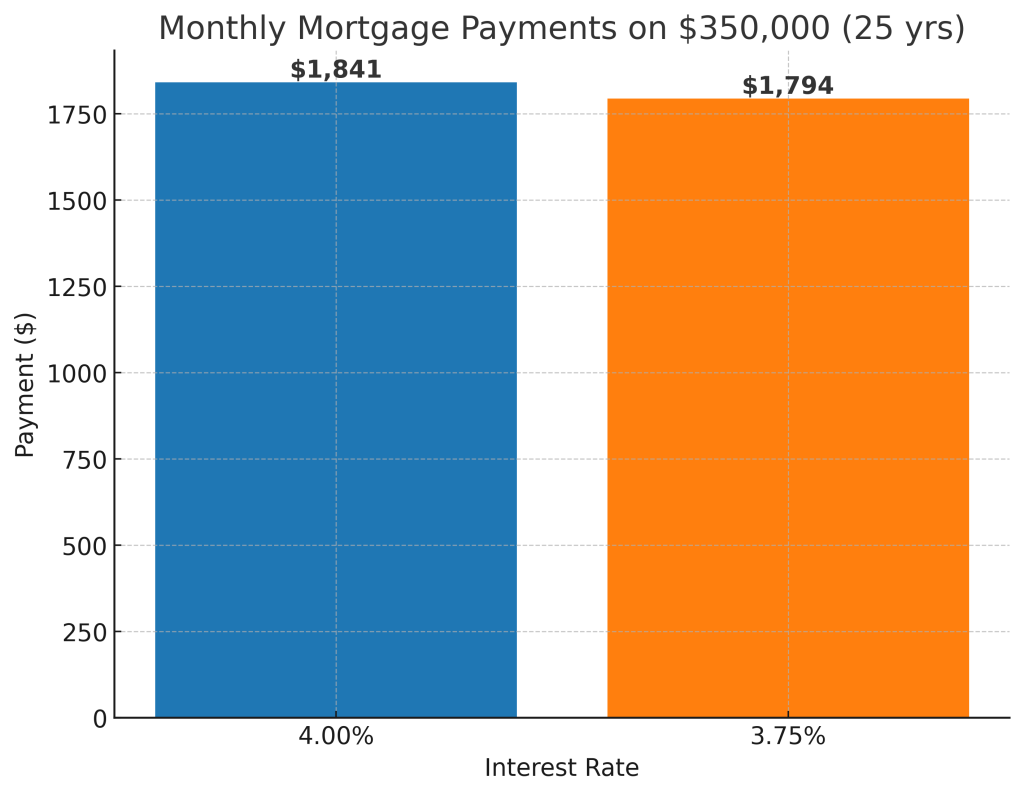

💡 On a $350,000 mortgage with a 25-year amortization:

-

At 4.00% → $1,841/month

-

At 3.75% → $1,794/month

That’s a savings of about $47 per month. Even better, if payments stay at the higher amount, a borrower could shave over a year off their mortgage—paying it off in 23 years and 10 months instead of 25 years.

👉 Quick rule of thumb: every 0.25% cut = about $15/month savings per $100,000 owed.

Key Reminders

✔️ Adjustable-rate mortgages: Payments move with Bank of Canada rate changes.

✔️ Fixed-rate mortgages: No changes—these are tied to bond markets.

➡️ As of today, most banks’ prime rate is 4.70%.

Why the Bank of Canada Cut Rates (and What It Means for Buyers)

Canada’s economy shrank 1.5% in Q2, with weaker investment and exports. Inflation remains steady at around 2.5%, but unemployment rose to 7.1% in August. Globally, the U.S., Europe, and China are also showing signs of slower growth due to trade challenges.

👉 [Link: https://www.bankofcanada.ca/2025/09/fad-press-release-2025-09-17/]

The Bank’s goal? To stimulate growth while keeping inflation under control. The next announcement is scheduled for October 29th.

Why First-Time Homebuyers Canada Hesitate Despite Lower Rates

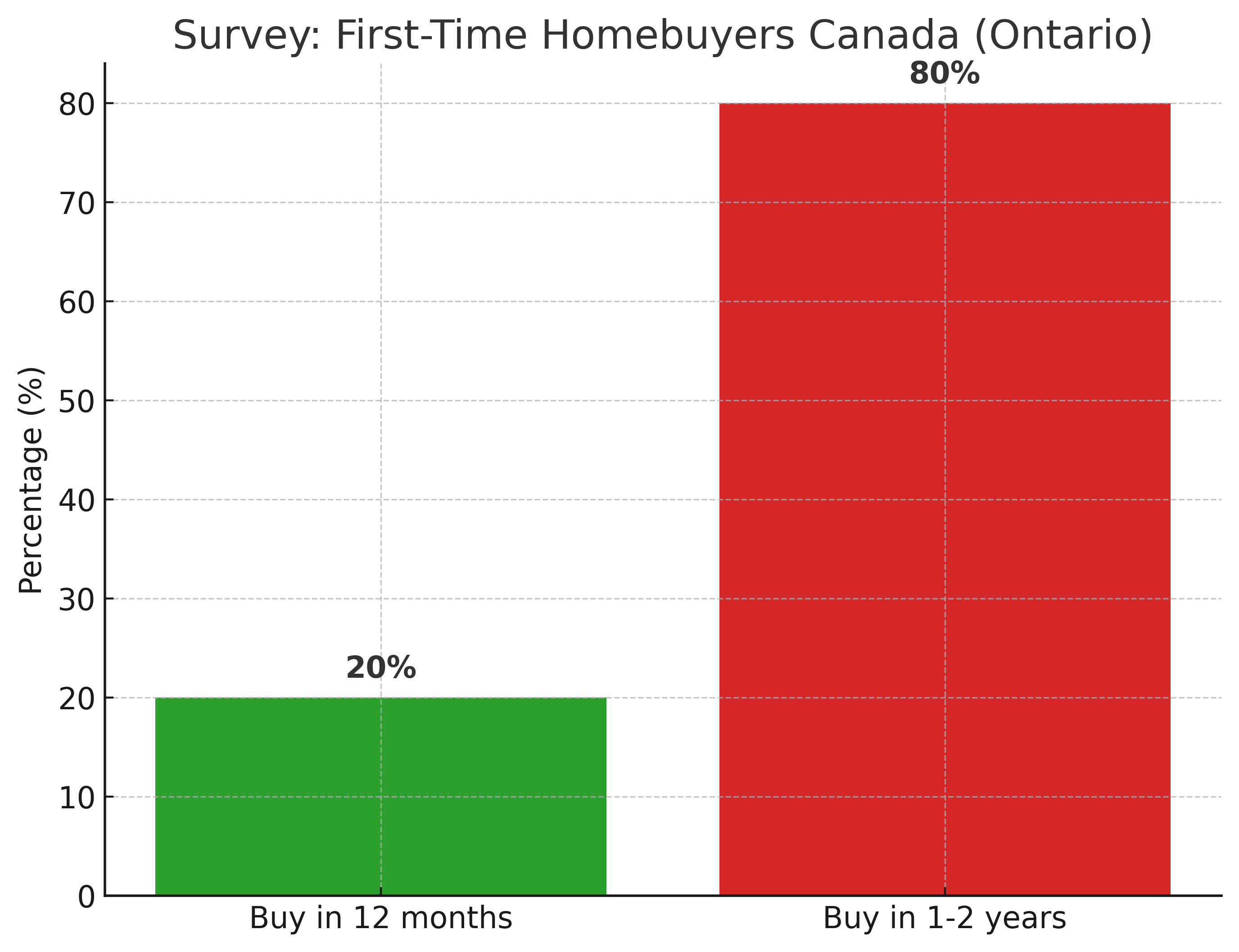

Despite lower rates, many first-time homebuyers Canada is tracking remain cautious. A Royal LePage survey shows:

-

15% plan to buy in the next two years.

-

80% of those buyers are waiting one to two years.

-

Only 20% are ready to buy within 12 months.

👉 [Link: https://www.royallepage.ca/en/realestate/news/]

Why the delay? Buyers want reassurance that prices won’t dip further. As Toronto realtor Tom Storey explained: “No one wants to buy, and then see the property worth less two months later.”

Who Are Today’s First-Time Homebuyers in Canada?

The survey also revealed new buyer profiles. Many first-time homebuyers in Canada are now over the age of 35. After renting in controlled units for years, they’re finally ready to purchase.

Other key findings:

-

43% will receive family assistance.

-

54% aim for a detached home, though condos dominate Toronto.

-

73% budget between $500,000 and $750,000.

-

54% plan a down payment of at least 20%.

👉 [Link: https://www.royallepage.ca/en/realestate/news/]

What This Market Means for Canada First-Time Buyers

Lower rates mean it’s easier to qualify for a mortgage, and payments are slightly lower. At the same time, inventory is increasing, which gives buyers more choice. However, uncertainty in the economy means many are waiting to see where prices go.

For first-time homebuyers Canada, this is a unique opportunity: the right preparation now could make all the difference when it’s time to act.

Final Thoughts for First-Time Homebuyers Canada

The combination of lower interest rates and rising inventory creates opportunities—but only for those ready to move with the market. In other words, buyers who prepare now can position themselves for success, even while others hesitate.

📩 Have questions about how this affects your mortgage or buying strategy? Contact me today and let’s talk through your options.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link